As per RBI regulations, the video KYC verification process starts with collecting the customer’s consent to use their personal information for verification. To comply with these regulations, there are only two options available for any Financial Institution - building an in-house video KYC solution or buying a ready-to-use VCIP infrastructure. In this article, we try to give you an answer to that question and represent overall information about build vs buy video KYC infrastructure.

Understanding VCIP Infrastructure

VCIP Infrastructure is a framework that starts with onboarding a customer to complete the process with the end-to-end secure and reliable approach in a particular session. The purpose of this framework differs from user to user according to their scenario.

What is Needed to Build Complete VCIP KYC Solution?

Building an in-house VCIP KYC Solution implicates diverse features and technologies to securely verify identities through video calls. To start, it is crucial to follow an effective implementation process.

Tech Stack

To ensure compatibility with the desired tech stack, it is important to choose tools and technologies that seamlessly integrate with the chosen components. Leveraging the appropriate technology frameworks like JavaScript, React, React Native, Flutter, Android, and iOS ensures compatibility with the tech stack.

Software Platform

To develop a web application for video KYC, use open-source platforms like JITSI, JANUS, or any similar private platforms. These platforms offer flexibility and customization options, but they come with certain limitations with scalability. But it is costly when you need custom features to enhance, also they may lack enterprise-grade security features required for identity verification and fraud prevention.

Team of Executives

To build video KYC Infrastructure, it is important to have a well-structured team in place. Team executives will play a crucial role in maintaining video KYC solutions and implementing and managing the infrastructure. They will be responsible for ensuring compliance with regulatory guidelines and integrating necessary features.

The Challenge of Building Video KYC Infrastructure

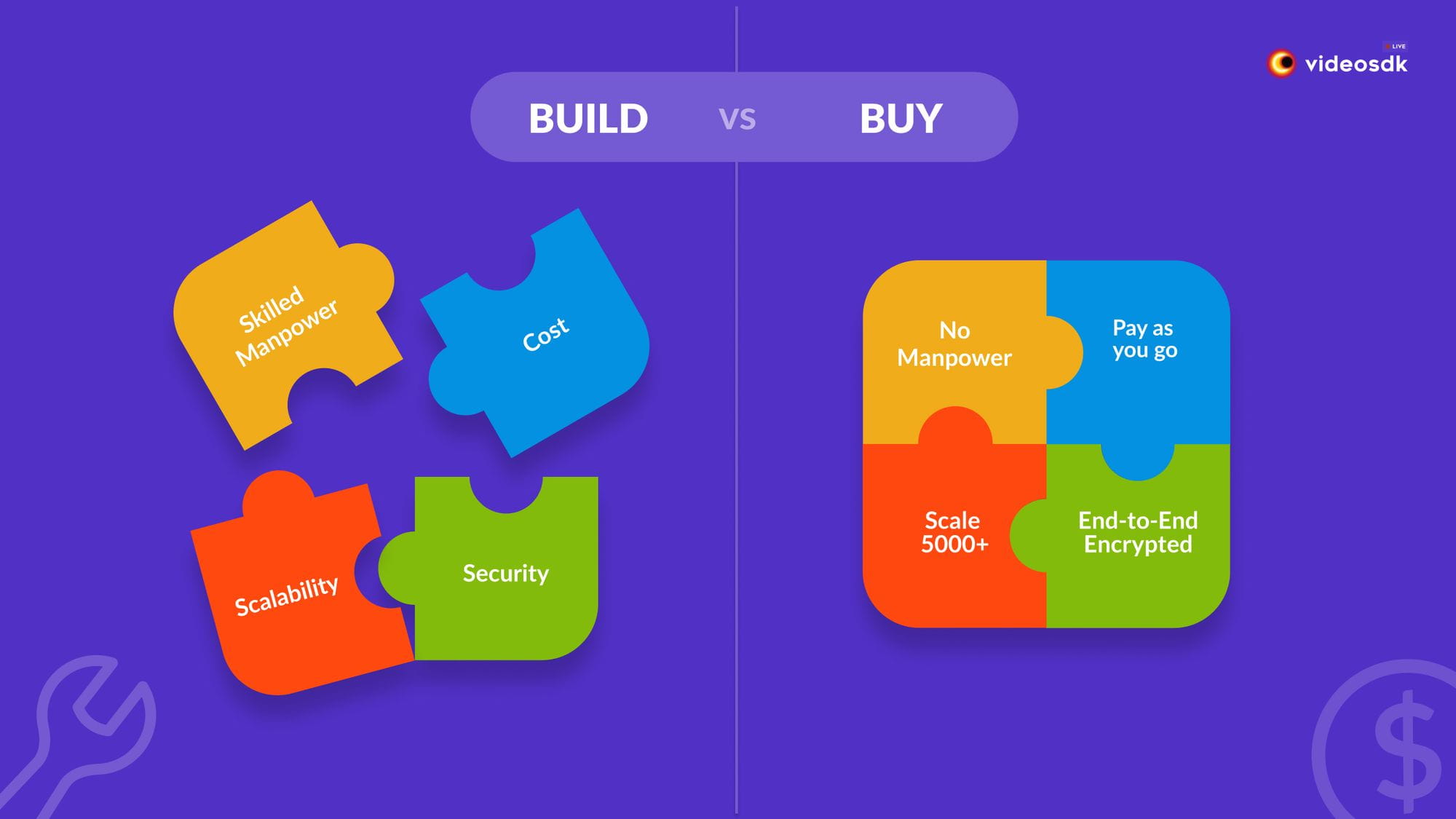

When choosing between building and buying Video KYC infrastructure, organizations must consider factors such as implementation process, tech stack compatibility, software platform features, team requirements, deployment options, compliance management, identity verification capabilities, security measures, scalability, data security, and customization options.

If the video KYC infrastructure is built using JITSI and JANUS's core features, they should add some more layers to be compatible. These must have extra layers that can provide enterprise-grade security features and additional capabilities.

Building In-house KYC Infra v\s Buy Video KYC InfraTech Solution

| Requirements for Building KYC Infrastructure | Buy Ready-to-use InfraTech Framework | |

|---|---|---|

| Compliance Management | Organizations need to incorporate compliance management solutions to ensure regulatory compliance. (Not available in Open Source Platforms) | Provides built-in compliance management solutions to ensure regulatory compliance with RBI Guidelines for CERT-in and VAPT acceptance. |

| Complete On-Premises Deployment | Allows organizations to have complete control over data security by deploying the solution on their own servers. (Sometime lack when high demand) | Offers a solution hosted on the provider's servers, ensuring data security and protection. |

| Face Match Comparison | Requires integrating AI algorithms to compare customer's face with the photo on their government-issued ID for identity verification. Additional integration with third-party identity verification services may be needed. | Offers AI-powered face match comparison for identity verification, with integrated third-party identity verification services for enhanced authenticity. |

| Geo-Location Capture and IP Check | Requires capturing customer's location and performing IP checks to prevent fraud and unauthorized access. | Offers built-in geo-location capture and IP check features for fraud prevention. |

| End-to-End Encryption for Video | Requires implementing advanced encryption algorithms and protocols to secure data exchanged during video calls. | Provides end-to-end encryption for video calls to ensure data privacy and security. |

| Unlimited Video Storage and Instant Retrieval | Organizations need to provide unlimited video storage to meet compliance requirements. | Offers unlimited video storage and instant retrieval of video recordings for compliance purposes. |

| Battling Security Threats | Organizations need to implement robust security measures to detect and prevent security threats such as fake identity documents and pre-recorded videos. | Provides advanced security measures to battle security threats, ensuring protection against fraud and illegal activities. |

| Real-Time OVD Verification | Requires instant verification of government-issued identity documents for compliance. | Offers real-time verification of government-issued identity documents for regulatory compliance. |

| Cost Analysis | Consider the cost of hiring and retaining skilled personnel, development tools, infrastructure, and ongoing maintenance. | Evaluate the upfront purchase cost, licensing fees, and ongoing subscription or maintenance fees. Compare these costs over time. |

| Time-to-Market | Developing an in-house solution may take longer, especially if it requires research and development from scratch. | Purchasing an existing solution can significantly reduce time-to-market as the product is already developed and ready to use. |

| Customization Needs | If your organization requires a highly customized solution tailored to specific requirements, building in-house may be the better option. | Third-party solutions may have limitations in terms of customization. Evaluate if the available features meet your needs without extensive modification. |

Additional Core Regulatory Layers

| Build Framework | Buy Framework | |

|---|---|---|

| Flexibility | Depends on the organization's requirements and size, requiring high-end customization to support different customer journeys. | Offers high-end customization to accommodate diverse customer needs and ensure a smooth and personalized KYC experience. |

| Auto Scalability | Organizations need to ensure their infrastructure can scale up or down based on customer volume. | Provides auto scalability to handle sudden spikes in customer volume without performance issues or downtime. |

| Data Security | Requires implementing robust data encryption and security measures to protect customer data from unauthorized access or breaches. | Ensures data security by implementing robust encryption, firewall proxy support, and purging mechanisms to protect customer data. |

So, building a new infrastructure from scratch can be expensive, requiring substantial investments in technology, resources, and expertise. First Layer Solution providers solve this issue very efficiently. By using a ready-to-use infrastructure, organizations can avoid the need to build their own internal stack from scratch and instead leverage a pre-built

Benefits of Buying Video KYC InfraTech Solution

Requirements of BFSI organizations differ depending on their size and specific needs. For example, consumer fintech startups and small union banks may have different priorities than mid-sized or large banks for VCIP. It's crucial for organizations to carefully consider their unique needs and choose the right video KYC infrastructure.

One of the significant advantages of opting for Video KYC InfraTech Solutions is security and cost-effectiveness. This type of PaaS solution has all types of features. This not only streamlines the onboarding process but also reduces operational costs, minimizes fraud, and ensures compliance with regulatory guidelines. The first-layer solution provider offers customization options, scalability, and reliability, allowing organizations to efficiently onboard more customers.

This cost advantage allows organizations to allocate their resources more efficiently and focus on other critical areas of their business. Thus, a ready-to-use infrastructure provides not only the benefits mentioned above but also a cost-effective for organizations looking to implement video KYC solutions efficiently.

Which Should Be Good for Financial Organizations?

The decision to build or buy video KYC infrastructure is crucial for organizations in the BFSI sector. Building an in-house infrastructure requires significant investments in technology, resources, and expertise. On the other hand, buying a ready-to-use solution offers cost-effectiveness, streamlined onboarding processes, reduced operational costs, and compliance with regulatory guidelines.

Both Options are good but buying a ready-to-use VCIP infrastructure from a Video solution expert offers several advantages. They obtain compliance with CERT-in and VAPT from the RBI. They affirm their commitment to maintaining the highest standards of security and regulatory compliance.

When it comes to choosing the best company to look out for, VideoSDK stands out from the competition. Banks and fintech companies can benefit from a better identity verification SDK or solution by leveraging VideoSDK's pre-built infrastructure without the need to build their own internal stack from scratch. This not only saves time and resources but also ensures a streamlined onboarding process, reduced operational costs and minimized fraud.

With VideoSDK, organizations can trust in their customization options, scalability, and reliability, enabling them to efficiently onboard more customers while remaining compliant with regulatory guidelines. Choose VideoSDK for a comprehensive and reliable video KYC solution that puts security and compliance at the forefront.

You can talk with our team if you have any questions regarding Video KYC compliances or Infrastructure.